Tag Archives: HELB LOANS

Lower Helb loan interest rates, increased repayment grace period for beneficiaries in the pipeline

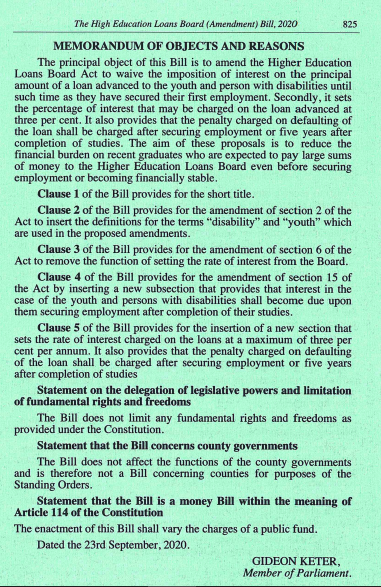

Beneficiaries of Higher Education Loans Board, Helb, funding would pay reduced loan interest rates if a Bill by Hon Gideon Keter (who is a Jubilee Party nominated Member of Parliament represent Youth interests in the National Assembly) sails through.

“The aim of this proposals is to reduce the financial burden on recent graduates who are expected to pay large sums of money to Helb even before securing employment or becoming financially stable…… It sets the percentage of interest that may be charged on the loan advanced at three percent. It also provides that the penalty charged on defaulting of the loan shall be charged after securing employment or five years after completion of studies.” Reads the bill that was tabled in Parliament.

The agency in January this year said it was pursuing some 78,328 defaulters holding Sh7.7 billion as at December 31 last year (2019).

If passed, the new law will provide a big relief to thousands of unemployed youths who have hge Helb loan balances to clear.

There has been a sharp increase in university enrollment, since 2014, a scenario that has seen rise in demand for loans.

In line with the current Cost Sharing Policy, where Government sponsored students receive about 80% GoK subsidy, HELB can therefore award a maximum loan of Sh60,000 and a maximum bursary of Sh.8,000.

See also;

- HELB loans and bursaries for TVET students; 2020/2021 first time loan applications

- Higher Education Loans Board, HELB, to publish names of defaulters since 1975 on newspapers; This is what you should do.

- HELB Loans and scholarships for all students; A detailed description

- Helb loan refund; How to get the refund plus the HELB Loan Recovery Enquiry form

- HELB LOANS, WEBSITE, PORTAL & SERVICES: Your ultimate guide on all requirements, application, disbursement and repayment of HELB Loans and Bursaries

- How to apply for HELB loan clearance, compliance certificate and refund; requirements and process

- Helb student loans; How to repay Helb loans via Mpesa, Bank Deposit, Wave, World Remit, Diaspora Payment methods

- Helb- This is all you need to know concerning helb loans; application, processing, disbursement, repayment and clearance

HELB LOANS: Your ultimate guide on all requirements, application, disbursement and repayment of HELB Loans and Bursaries

UNDERGRADUATE LOANS

These loans are for students joining public or private universities within the East African Community directly from high school either through the Kenya Universities and Colleges Central Placement Service (KUCCPS) or as self-sponsored. Amounts awarded range between Kshs.40,000 minimum and Kshs.60,000 maximum based on the level of need. The loan attracts interest of 4% p.a and the students are required to repay their loans on completion of their studies. Students are advised to apply at least one month before the opening date to allow ample time for processing.Type of Loan Application

There are two types of undergraduate loan applications:- First Time Application-This is for applicants who are applying for the first time.

- Second & Subsequent Application-This is for applicants who are applying for a second, third, fourth time as per the program duration

Management of HELB Loans

Students are advised that the loans should be used mainly for:- Tuition,

- Books and stationery,

- Accommodation and subsistence.

Loan Award

The loan awarded ranges from a minimum of Ksh.40, 000 and a maximum of Ksh.60, 000. For those placed by Kenya University and Colleges Central Placement Service (KUCCPS), the loan amount is split to cater for both Tuition fee and Upkeep while the Self sponsored students, the money is sent directly to the university once a year as tuition fees. A standard amount of Ksh4, 000 for Government sponsored students only is deducted from the loan awarded and disbursed to the university per semester for tuition [total Ksh8, 000] and the rest is sent to the applicant’s bank account as upkeep. An Administrative Fee of Ksh500 per year is charged on the loan awarded and it is therefore deducted from the disbursed loan. A limited number of needy government sponsored students receive bursary of between Ksh4, 000 and Ksh8, 000 per year. The Bursary is paid to the university.Requirements

- A copy of the Applicant’s national ID Card

- Copies of the parents national ID Cards/death certificate where the parent is deceased

- Copies of both guarantors’ national ID Card

- A copy of the applicant’s admission letter and KCSE result slip/certificate

- A copy of the applicant’s Bank ATM/Bank card (for Government sponsored students only)

- A copy of the applicant’s Smart Card from the institution

- One recent colored passport size photograph of the applicant.

Repaying your Student Loan

Undergraduate loan repayment starts within one year of completion of studies or within such a period as the Board decides to recall the loan whichever is earlier. However, you can make voluntary payments before or after you complete your studies to reduce your loan balance. Note:- Loans are charged 4% interest per annum

- Loan repayment commences one year upon completion of studies or as deemed fit by HELB.

- The loan is repayable up to a maximum of 120 months.

Submission of undergraduate Loan Application Forms

Here are links to the most important news portals:

- KUCCPS News Portal

- TSC News Portal

- Universities and Colleges News Portal

- Helb News Portal

- KNEC News Portal

- KSSSA News Portal

- Schools News Portal

- Free Teaching Resources and Revision Materials

HOW TO APPLY FOR THE HELB FIRST TIME LOAN.

The First Time Loan Application is divided into the following categories.INFORMATION ON PROFILE

This comprises of two sub categories as elaborated below.Please fill each section before proceeding to the next item. a) Applicant:- Personal Details In this section, an applicant is required to fill out their personal information. Items such as Sub-location,Division,location etc should reflect information as per your National Identification Card. b) Applicant:- Residence Details In this section, an applicant is required to fill out there current place of residence information. Items such as Sub-location,Division,location etc should reflect your current place of residence and not as indicated in your ID Card.INSTITUTION DETAILS

This comprises of three sub categories as elaborated below.Please fill each section before proceeding to the next item. a) Applicant :- Institution Details In this section, an applicant is required to fill out their Institution details. b) Applicant :- Loan Information. Here you are required any information on your loan or bursary.EDUCATION BACKGROUND DETAILS

This comprises of one category as elaborated below.Please fill each section before proceeding to the next item. a) Applicant :- Education Background Details In this section, an applicant is required to fill out their education background details.Primary and Secondary School Details are compulsary.Failure to include this will lead to automatic disqualificationEXPENSE DETAILS

This comprises of two categories as elaborated below.Please fill each section before proceeding to the next item. a) Applicant :- Family Expenses In this section, an applicant is required to fill out the family’s expenses.GUARANTOR DETAILS

This comprises of one section as elaborated below.Please fill each section before proceeding to the next item. a) Applicant :- Guarantor’s Details In this section, an applicant is required to fill out the guarantor’s details.It is compulsory to fill in two guarantors failure to do this will lead to automatic disqualificationPARENTS DETAILS

This comprises of three category as elaborated below.Please fill each section before proceeding to the next item. a) Applicant :- Parents Marital Status In this section, an applicant is required to fill out their parent’s marital status. b) Applicant :- Parents Details In this section, an applicant is required to fill out various details about their parent’s eg.employment. c) Applicant :- Guardian’s Details If the applicant is orphaned he/she will be required to fill in the gurantors’ details.BANK DETAILS

This comprises of one section as elaborated below.Please fill each section before proceeding to the next item. a) Applicant :- Bank Details In this section, an applicant is required to fill out the bank’s details. To get started off click on this link; https://portal.helb.co.ke/TVET HELB LOANS

Students pursuing Diploma and Certificate courses in Public universities, university colleges, public national polytechnics and Institutes of Technology and Technical Training institutes country-wide are eligible for this loan and bursary. Orphans, single parent students and others who come from poor backgrounds will be given priority for the loans and or bursaries. The application period is January to April every year.Required Documents

- Applications should access and fill the relevant TVET Loan & Bursary Application Form (TLAF).

- Print TWO copies of the duly filled Loan Application Form.

- Have the TVET Loan Application Form signed and stamped by the Dean of Students/Financial Aid Officers.

- Retain one copy of the duly filled TLAF (Mandatory).

- Drop the TLAF personally at the HELB students Service Centre on the Mezannine One, Anniversary Towers or any of the SELECT Huduma Centers nearest to you.

Submission of TVET Loan Application Forms

How to apply for the HELB Afya Elimu Loan; 2nd and subsequent

The Higher Education Loans Board, Helb, is inviting applications for the Afya Elimu second and subsequent loan application 2020/2021 academic year. Get full details on how to apply and requirements in this post.

ELIGIBLE STUDENTS

This loan is available for needy students training in middle level medical colleges (listed on HELB portal); Kenya Medical Training College [KMTC], Faith Based Organizations [FBO’s] and other Institutions offering Diplomas and Certificates in medical courses

HOW TO APPLY.

- Download the HELB App from Google Play Store or dial *642#

- Register using your phone number to generate a PIN which you will use to log in

- Ensure the mobile number is registered under your name

- Please NOTE that mobile numbers not registered in the students’ name will not allow the loan application to proceed

- Read, understand, and click to accept the license agreement

- Enter your First name as it appears in your National ID, ID number and valid email address to complete registration.

- Click on “loans” tab and choose either certiFicate loans or diploma loans. Then click “apply” on the Afya Elimu second and subsequent loan

- Read and understand the Financial literacy guide

- Answer the inancial literacy questions and scroll down to view results and click “proceed”

- Click “conirm” to verify your telephone number by paying Kshs. 1 to M-PESA

- Read the loan agreement and click on ‘I agree’

- Click ‘submit’. A pop-up message will appear to show that you have successfully applied. The loan serial number will also be displayed.

Please note that this application is paperless. You are not required to print any form. A confirmation SMS with a loan application serial number is the evidence that you have applied. Kindly save the SMS for future reference.

DO NOT PAY anyone to process your HELB loan application.

In case of any queries, seek assistance ONLY from HELB officers.

DEADLINE

The closing date for the loan application is January 31, 2021

SEE ALSO;

- HELB LOANS, WEBSITE, PORTAL & SERVICES: Your ultimate guide on all requirements, application, disbursement and repayment of HELB Loans and Bursaries

- Helb- This is all you need to know concerning helb loans; application, processing, disbursement, repayment and clearance

- Guide to the HELB Mobile Short code used for loan repayment, application and Disbursement status

- Helb undergraduate loans latest news: Amount awarded, disbursement and requirements: Full details

- How to apply for HELB loan clearance, compliance certificate and refund; requirements and process

- How to apply for HELB Post Graduate Scholarships for Masters and PHD students: Plus Requirements

- Helb student loans; How to repay Helb loans via Mpesa, Bank Deposit, Wave, World Remit, Diaspora Payment methods

- Complete information about the Higher Education Loans Board, Helb; Loan applications and repayments

How to apply for HELB undergraduate second and subsequent loans: Mobile USSD Code and App

The Higher Education Loans Board, Helb, has opened the window for submitting undergraduate students’ second and subsequent loan applications. This loan is available for all Kenyan students admitted in in Public and private universities in Kenya and the East African region. The deadline for submitting your loan application is June 30, 2020.

REQUIREMENTS

For you to qualify for these loans you must meet the requirements below:

- You must be admitted in a public or private university offering programmes that are recognized by the commission for university education, CUE.

- You must be undertaking a bachelor’s degree; self-sponsored, parallel and module II programmes.

- You must be a recent beneficiary of the undergraduate loans. (This is application is not available for first time applicants).

HOW TO APPLY

You can apply for the loan easily by using any of the methods below;

- Using the HELB mobile app

- Using the mobile USSD code *642#

- Applying online

SEE ALSO;

- HELB LOANS, WEBSITE, PORTAL & SERVICES: Your ultimate guide on all requirements, application, disbursement and repayment of HELB Loans and Bursaries

- Helb- This is all you need to know concerning helb loans; application, processing, disbursement, repayment and clearance

- Guide to the HELB Mobile Short code used for loan repayment, application and Disbursement status

- Helb undergraduate loans latest news: Amount awarded, disbursement and requirements: Full details

- How to apply for HELB loan clearance, compliance certificate and refund; requirements and process

- How to apply for HELB Post Graduate Scholarships for Masters and PHD students: Plus Requirements

- Helb student loans; How to repay Helb loans via Mpesa, Bank Deposit, Wave, World Remit, Diaspora Payment methods

- Complete information about the Higher Education Loans Board, Helb; Loan applications and repayments

USING THE HELB MOBILE APP

If you have a smart phone, then the cheapest way of submitting your application ;is by using the HELB mobile app:

- Download the mobile app from Google play. Just search for HELB in Google play and click ‘install’.

- Once successfully installed, register details.

- You will then be expected to read notes/ instructions.

- Now, select the loan application form.

- Fill in the details, correctly, and submit by clicking ‘OK’.

HOW TO REGISTER FOR LOAN MOBILE SERVICES.

Another way you can use to apply for the loan is by utilizing the mobile USSD code. Register by using the steps below:

- Go to your dialer on your mobile and enter *642# and send.

- Then Select/ enter 1 and send.

- On the next window prompts, provide your: First name, last name, National ID number, date of birth.

- Enter a PIN you can easily remember and confirm it.

- A registration success message will be displayed thus: “Thank you for registering with the HELB mobile platform. You will receive SMS Confirmation Shortly.”

- Then, proceed to make your loan application.

APPLYING ONLINE.

This is yet another method via which the loan application can be filed.

- Visit the Helb portal by visiting the link; https://portal.helb.co.ke/auth/signin

- Enter your email address and password then click ‘Sign in’.

- Select the loan application name to get the application form. Fill it and submit. (Only The Products in Green Background Are Open for Application. Click On Row Of The Loan Product You Wish To Apply For)

Kisii university May-August semester details

Procedure used for HELB loans and bursaries applications for TVET students

TVET STUDENTS FIRST TIME LOAN AND BURSARY APPLICATIONS FOR THE FINANCIAL YEAR 2020-2021

The Higher Education Loans Board(HELB) invites applications for First Time 2020-2021 TVET Loan and Bursary from Kenyan students admitted in National Polytechnics, Technical Training Institutions and Vocational Colleges under the Ministry of Education and are registered with Kenya Universities and Colleges Central Placement Service [KUCCPS] and Members of the Kenya Association Technical Training Institutions [KATTI).

Eligible students:

Applications are open to students enrolled in approved TVET courses and are applying for the first student loan.

How to Apply

- Applicants should visit our website http://www.helb.co.ke to access the Student Portal to register, create and activate account(ensure you use your personal mobile number)

- Log in, go to Loan Application, click Certiicate (Artisan and Craft) or Diploma and select the 2020-2021 TVET First Time Loan Application Form [LAF].

- Read and appraise oneself online on Financial Literacy and appreciate the purpose of credit.

- Access and fill the loan application form.

- Print TWO copies of the duly filled Loan Application Form. Ensure you preview the form

- and correct where necessary before you submit for printing

- Have the forms appropriately filled, signed and stamped by the relevant authorities.

- Read, understand and sign to accept the Loan Terms and Conditions and Data Protection Consent form.

- Present one copy of the duly filled Loan Application Form and all the attached support documents at:

- Any of the following Huduma centers with HELB desk nearest to you: Nairobi-GPO, Machakos, Mombasa, Nakuru, Eldoret, Kisumu, Kakamega, Kisii, Nyeri, Embu, Kitui, Bungoma, Lodwar, Meru, Thika, Kitale, Kericho, Nandi, Murang’a, Garissa, Narok, Migori, Chuka, Kilifi, Taita Taveta, West Pokot, Bomet and Makueni for free and secure delivery, OR

- HELB Student Service Centre on Mezzanine 1, Anniversary Towers, University Way, Nairobi, OR

- Send through registered and secured mail or courier.

- Retain a copy of the duly filled and signed Loan Application Form [This is mandatory]

Please note that this application is paperless. You are not required to print any form. A confirmation SMS with a loan application serial number is the evidence that you have applied. Kindly save the SMS for future reference.

See also; HELB Afya Elimu second and subsequent loan application 2020/2021; Second and subsequent

DEADLINE

The closing date for the loan application is January 31, 2021.

kINDLY NOTE;

- DO NOT PAY anyone to process your HELB loan application.

- In case of any queries, seek assistance ONLY from HELB ofFicers.

SEE ALSO;

- HELB LOANS, WEBSITE, PORTAL & SERVICES: Your ultimate guide on all requirements, application, disbursement and repayment of HELB Loans and Bursaries

- Helb- This is all you need to know concerning helb loans; application, processing, disbursement, repayment and clearance

- Guide to the HELB Mobile Short code used for loan repayment, application and Disbursement status

- Helb undergraduate loans latest news: Amount awarded, disbursement and requirements: Full details

- How to apply for HELB loan clearance, compliance certificate and refund; requirements and process

- How to apply for HELB Post Graduate Scholarships for Masters and PHD students: Plus Requirements

- Helb student loans; How to repay Helb loans via Mpesa, Bank Deposit, Wave, World Remit, Diaspora Payment methods

- Complete information about the Higher Education Loans Board, Helb; Loan applications and repayments

Light Academy, Nairobi; KCSE Performance, Location, History, Fees, Contacts, Portal Login, Postal Address, KNEC Code, Photos and Admissions

Light Academy Boys’ Secondary School (Karen, Nairobi)

Light Academy Boys is a privately owned secondary school. The school is located in Karen-C off Langata Road.

Light Academy Boys’ Secondary School Contacts

- Postal Address: Light Academy Schools PO BOX 13413 00100 GPO Nairobi / Kenya

- Tel: +254 (0) 724 10 00 00

- Website: http://844.lightacademy.ac.ke/

- Twitter Handle: @Light_Academy

- KNEC Code: 20404006

Light Academy Boys’ Secondary School: Mission

Light Academy Boys’ Secondary School: Vision

Light Academy Boys’ Secondary School: Values

-

Leadership

-

Integrity

-

Good Judgement

-

Honour

-

Trustworthiness

FOR A COMPLETE GUIDE TO ALL SCHOOLS IN KENYA CLICK ON THE LINK BELOW;

Here are links to the most important news portals:

- KUCCPS News Portal

- TSC News Portal

- Universities and Colleges News Portal

- Helb News Porta

- KNEC News Portal

- KSSSA News Portal

- Schools News Portal

- Free Teaching Resources and Revision Materials

Light Academy Boys’ Secondary School: School Uniform

- A pair of grey trousers

- Light Blue Jersey (with school Logo imprinted) either short sleeved or long sleeved

- Black Jacket

- A pair of black leather shoes

- Pairs of socks (black or grey)

Light Academy Boys’ Secondary School: KCSE Results Analysis

A renown academic giant, Light Academy continues to string back to back impressive results in the Kenya Certificate of Secondary Education (KCSE) exams. In the 2018 exams the school had 26 candidates who managed a mean score of a B+ (plus); with a performance index of 72.141. In 2019 the total candidature stood at 102.

Light Academy Boys’ Secondary School: Photo Gallery

Also read:

- Kisii University Courses, Requirements, Fees, Student Portals and how to apply

- Kenya Methodist University, kemu, Education and other Courses, Requirements, Fees, Student Portals and how to apply

- Kibabii University Courses, Requirements, Fees, Student Portals and how to apply

- Karatina University Courses, Requirements, Fees, Student Portals and how to apply

- Kabaraki University Courses, Requirements, Fees, Student Portals and how to apply

- Education courses offered at Jaramogi Oginga Odinga, JOOUST, University:Requirements, Fees, Student Portals and how to apply

- Universities that offer education courses, teaching combinations, offered, requirements and how to apply for Chuka university courses

The HELB mobile app; How to use app to apply for students loans

The Higher Education Loans Board, HELB, has developed a mobile app that makes it easier for you to apply for students’ loans and scholarships. The mobile HELB mobile application that is available freely on Google Play enables you to apply for various loans including the second and subsequent undergraduate loans. And yes, the new app makes the HELB loan application process purely paperless i.e no physical copies are required during the whole application process.

Wondering how to install and use the new app? Worry not. We will take you on a step by step simplified process on how to successfully apply for your loan using your mobile phone.

Join our growing community on Facebook. Click the link below;

OFFICIAL EDUCATION & TSC NEWS CENTRE FACEBOOK PAGE

DOWNLOADING, INSTALLING AND USING THE NEW APP.

The HELB mobile app is one the best and user friendly apps. All that you need is a smart phone with play store and a few bundles. Then, follow the steps here, below:

- The first step is to install the app on your mobile phone. Open play store on your mobile phone (you can even use a friend’s mobile phone in case you do not own one). Then type ‘HELB’ and click ‘install’. (You can download the HELB mobile app available on GooglePlay and have fast and convenient access to all HELB services. Click on this link to get started

- Once successfully installed, you will be prompted to enter your phone number (Safaricom line only and must be registered under your name). Do this, followed by clicking ‘Generate PIN’.

- A verification code will be automatically sent to your mobile phone and also email address that is registered on the HELB portal. (In an event you do not receive the code within few minutes, click ‘Resend verification code’.

- Enter the verification code received and set your log on, PIN. Now, click ‘set PIN’.

- On the next window, enter your PIN (THE ONE YOU HAVE JUST SET), read the licence agreement and click ‘Accept’ to proceed.

- Complete yor registration in the next window by filling out the mandatory fields; First name, ID Number and Email address. ‘Select Register/ Proceed’.

Download free notes, revision materials, exams, CATs, termly exams, home works and marking schemes for all forms and classes here; CLICK ME NOW TO GET EXAMS FOR ALL SUBJECTS IN EVERY FORM & CLASS.

USING YOUR ACCOUNT DASHBOARD.

Now, you will automatically be redirected to your personal account dashboard. The account dashboard contains the following menu:

- Loans menu: Used to apply for certificate, diploma, undergraduate and post graduate loans and showing your loan status.

- Scholarships menu: For accessing undergraduate and postgraduate scholarships.

- Repayment menu: Used to check your loan balance and make repayments.

- Clearance menu.

- Account settings and contact us menu.

SEE ALSO;

- HELB LOANS, WEBSITE, PORTAL & SERVICES: Your ultimate guide on all requirements, application, disbursement and repayment of HELB Loans and Bursaries

- Helb- This is all you need to know concerning helb loans; application, processing, disbursement, repayment and clearance

- Guide to the HELB Mobile Short code used for loan repayment, application and Disbursement status

- Helb undergraduate loans latest news: Amount awarded, disbursement and requirements: Full details

- How to apply for HELB loan clearance, compliance certificate and refund; requirements and process

- How to apply for HELB Post Graduate Scholarships for Masters and PHD students: Plus Requirements

- Helb student loans; How to repay Helb loans via Mpesa, Bank Deposit, Wave, World Remit, Diaspora Payment methods

- Complete information about the Higher Education Loans Board, Helb; Loan applications and repayments

APPLYING FOR SECOND AND SUBSEQUENT STUDENTS’ UNDERGRADUATE LOANS

Seeking to apply for your second and subsequent loan? This loan is only available to students who have already applied for and/ or received a loan (s) from HELB (within the last three years). Read further guidelines vconcerning this loan here; HELB undergraduate students’ second and subsequent loans- You can now apply, requirements.

To proceed and make your application;

- Click ‘Loans’ from your HELB mobile app account dashboard, followed by ‘Undergraduate Loans’.

- Next, you will select ‘Undergraduate Second Subsequent Loan’, and click ‘Apply’.

- Update your personal, institution and employment details if required to.

- Proceed to filling out the form. Click ‘Ok’ to submit your form.

- Good luck.

Remember you can seek assistance from HELB by using mobile number; 0711052000 or via email; contactcentre@helb.co.ke

Helb loans; Students protest move to oppose making the loans cheaper

A section of University students from Murang’a County have expressed their frustrations over the rejection of the Higher Education Loans Board (HELB) Amendment Bill in Parliament.

The learners allied to Murang’a University Students Association (MUSA) condemned the lawmakers who rejected the bill saying the ongoing political affiliations in the education committee are misplaced priorities.

Led by their spokesperson Laban Macharia, the students said they will be writing a protest letter to the Speaker of the National Assembly because the move by parliament has denied university students a chance to improve their living standards.

The rejected Bill sought to increase the grace period for repayment of loans from one year to five years and decrease the loan interest from four to three per cent in order to help university students better their lives while in campus and after finishing their studies.

Parliamentary Committee on Education rejected the bill on grounds that, if the said proposals are affected the Board stands to lose Sh693 million annually and Sh4.3 billion in five years.

“The ongoing political divide should not be used in any way by legislators to settle their political scores, comrades are suffering in campus due to the high cost of living that has already been made worse by Covid-19,” Macharia said.

Another students’ leader, Felister Wanjiku, also castigated the Members of Parliament for failing to consider the lives of struggling youths who just graduated from school and have to pay loans even before being employed.

The students, however, lauded Embakasi East MP Babu Owino’s move to re-introduce the bill in Parliament after six months and urged other legislators to support it.

Students who do not secure jobs immediately after completing their studies will be shielded by the Bill as they would have a five-year grace period before they start repaying their loans as well as avoid a Sh5, 000 monthly penalty HELB imposes on defaulters.

SEE ALSO;

- HELB LOANS, WEBSITE, PORTAL & SERVICES: Your ultimate guide on all requirements, application, disbursement and repayment of HELB Loans and Bursaries

- Helb- This is all you need to know concerning helb loans; application, processing, disbursement, repayment and clearance

- Guide to the HELB Mobile Short code used for loan repayment, application and Disbursement status

- Helb undergraduate loans latest news: Amount awarded, disbursement and requirements: Full details

- How to apply for HELB loan clearance, compliance certificate and refund; requirements and process

- How to apply for HELB Post Graduate Scholarships for Masters and PHD students: Plus Requirements

- Helb student loans; How to repay Helb loans via Mpesa, Bank Deposit, Wave, World Remit, Diaspora Payment methods

- Complete information about the Higher Education Loans Board, Helb; Loan applications and repayments